What Is an OCIO?

OCIO is short for “Outsourced Chief Investment Officer”

An OCIO is a specialized investment firm that replicates the experience of having an in-house chief investment officer, supported by a deep bench of asset class specialists and a fully-staffed back office.

History of the OCIO Model

In 1987, a group of senior staff members of The World Bank pension investment division left to form Strategic Investment Group. Then-Chief Investment Officer, Hilda Ochoa-Brillembourg, conceived of Strategic as an “investment department for hire” for institutions that need significant expertise and resources to manage their assets, but are unable or prefer not to hire a chief investment officer and internal investment staff.

The ethos of these pioneering firms (and others that have adopted their business model) is to hew as closely as possible to the structure, personalized relationships, and dedication of the best-staffed internal investment offices. For this reason, they choose to remain mid-sized boutiques that focus solely on OCIO.

OCIO clients typically include non-profit organizations (e.g., endowments, foundations, health care providers, and other charitable organizations) dependent on investment returns to fulfill their core goals, and corporations seeking help with the management of their employee retirement plans.

Over the years, the continued evolution and specialization of the investment markets has led to major growth in the number of institutional investment committees looking for help with their increasingly complicated responsibilities. And the success achieved by pioneers of the OCIO model has driven many diverse financial services firms – including some of the industry’s largest players – to try to cash in on this movement by offering various forms of “investment outsourcing” services.

This is all well and good when properly understood. There are many ways to provide outsourced investment services, and OCIO is not the best solution for all organizations. However, many outsourcing firms in today’s marketplace are claiming to be OCIOs when they are not. This practice has led to a dilution of the OCIO “brand” and confusion among potential clients. It’s important to appreciate what sets the OCIO model apart in order to know whether an outsourcing provider is really an OCIO, and whether OCIO is right for your organization.

Three Defining Features of the OCIO Model

The OCIO model provides an organization’s investment committee (or its equivalent) with the three inherent advantages of having an internal chief investment officer:

- the reassurance of a partner that accepts investment discretion and is accountable for the performance of the organization’s portfolio;

- the 360-degree support of a bespoke and comprehensive asset management program focused on delivering alpha and backed by the ease of turnkey back-office services; and

- the integrity and independence of a conflict-free service model with no competing business lines or financial ties to the managers and service providers selected for the organization’s portfolio.

An outsourcing firm that doesn't offer all three of these elements is not a true OCIO.

Why? Because, like an internal chief investment officer...

An OCIO works with a client’s investment committee to determine appropriate investment goals, asset classes, and risk parameters. From there, depending on the investment committee’s preference, the OCIO is prepared to accept up to full discretion for asset allocation and manager selection. This delegation of investment decision-making responsibility means that the OCIO has front-line accountability for the performance of the organization's portfolio – just like an internal chief investment officer.

An OCIO is singularly focused on providing the “bespoke” services of an internal CIO, in a way that is accessible to a broader range of organizations. The OCIO model provides all the elements of an internal CIO at significantly less burden and expense, plus it creates economies of scale that enhance alpha potential and manager access.

An internal chief investment officer typically is paid a salary (and, perhaps, a bonus for performance) and doesn’t receive additional fees or revenue from the organization’s external managers or service providers. This means an internal chief investment officer has the incentive and freedom to find the best managers/service providers from an open pool of candidates. This may not be true of other (non-OCIO) outsourcing providers, many of which earn significant additional income by placing client assets in proprietary products or have revenue-generating arrangements with the managers and service providers they hire for their clients. These arrangements create possible conflicts of interest that must be reviewed carefully by an investment committee to ensure they are in the best interest of the organization. A true OCIO that is paid solely based on client assets under management (and, in some cases, performance) has no financial incentive to hire any particular manager. Like an internal chief investment officer, an OCIO is free to take an “open architecture” approach to investing, with the goal of finding the best investment management talent for the organization in each asset class.

OCIO vs. Other Outsourcing Options

An OCIO relationship is designed to be comprehensive: An OCIO typically handles all aspects of an organization’s investment needs, providing maximum assistance to the investment committee, in a fiduciary capacity, while seeking to minimize any conflicts of interest. Not all investment committees require or want this level of assistance. When deciding whether to hire an OCIO versus another type of outsourcing provider, consider how much support your organization needs. An investment committee that is comfortable making complex, time-sensitive judgment calls, assessing potential conflicts, and that has specialized internal support staff, may not need an OCIO and may be able to save money (or at least out-of-pocket costs) by hiring another type of outsourced service provider. However, for an investment committee with time and/or knowledge constraints – a situation in which many investment committees find themselves – an OCIO likely is a better solution.

Other financial services firms that provide “outsourced investment services” include investment consultants, banks, multi-product managers-of-managers, and mutual fund complexes. They each have an important role to play in the investment industry and provide valuable services to their clients in the right contexts. But their services and business models differ from OCIO in important ways and should not be labeled “OCIO” unless they provide the three key features of the OCIO model: fiduciary responsibility, investment discretion with primary accountability, and financial independence from the managers and service providers selected for clients.

Investment Consultants

A consultant provides investment expertise (and, in some cases, other financial services) on a periodic or a flexible, “as needed” basis. A talented consultant can be an excellent choice for an investment committee that needs guidance primarily on a high-level basis or with specific, complex issues and that has sufficient time, resources, governance infrastructure, and motivation to implement the organization’s investment plan.

The main differences between an OCIO and a consultant involve levels of service and methods of compensation.

A consultant recommends one or more elements of an investment plan, and then it's up to the client’s investment committee to select and implement the actual investments. Some consultants also offer an optional layer of execution services (sometimes called “implemented consulting”), but the investment committee still has decision-making responsibility. An OCIO makes investment decisions; handles all the nitty-gritty of manager selection and oversight, as well as operations and back-office processes; and is, therefore, primarily responsible for the operation and performance of the client’s portfolio.

A consultant provides investment advice when and to the extent specifically called upon to do so by a client’s investment committee. An OCIO is directly engaged with and responsible for the organization’s portfolio on a daily basis.

The consultant model also is decentralized, meaning that each client’s performance and the service level it receives will be a function of the individual overseeing its account. In the OCIO model, the entire firm works on each client’s portfolio to help provide consistency across clients in the investment process and with respect to customer service.

Many consultants (and other non-OCIO providers) earn income – in addition to their client fees – from multiple business models or compensation-sharing arrangements with other service providers. For example, there are consultants that:

- create their own investment firms and recommend them to their consulting clients;

- sell their own investment products to their consulting clients;

- charge third-party investment managers fees to be on a platform or list of managers they recommend to their clients;

- receive client referral fees from third-party investment managers;

- arrange conferences at which third-party investment managers pay for the opportunity to meet the consultant’s clients; and

- charge third-party managers for “training sessions” designed to help the managers market their services to consultants (which, in turn, could include the consultant providing the training).

There are excellent and ethical consultants that are upfront with their sources of income and also steer clear of the more questionable types of compensation arrangements. They strive to make investment recommendations solely in the best interests of their clients. But not all consultants are so careful or above board. An investment committee – as a fiduciary to the organization – has a duty to monitor and review the potential conflicts of interest of all its service providers on an ongoing basis. An OCIO does not accept fees or earn revenue from managers or service providers, so its financial interests are fully aligned with the success of its clients. An organization should consider how much bandwidth its investment committee has to oversee less straightforward compensation arrangements.

Some consultants (and other financial firms) also offer their clients separate "OCIO" services. We place OCIO in quotes, because the conflicts in the typical consultant compensation model make it unlikely that a combined consultant/”OCIO” firm can achieve the independence of a true, stand-alone OCIO. Even if a consultant’s "OCIO" business eschews the typical supplemental fee arrangements described above, the consultant may still have an economic incentive to favor its largest consulting clients over its smaller, "OCIO" clients when it comes to capacity-constrained investments. Some, less scrupulous consultants also adopt a completely different investment philosophy for the “OCIO side” of their businesses that favors more passive strategies (that are less expensive for the consultant to provide) and fewer alternative asset classes (to save the capacity for their larger consulting clients who generate bigger fees).

Banks

Banks have numerous business lines and typically offer a range of investment products and services, including proprietary funds and other ancillary financial services (e.g., accounting, audits, and custody). Their outsourcing services rely heavily on these proprietary funds and services, from which (like consultants) they earn additional revenue. As with the consulting model, the potential for conflicts of interest also is significant and must be monitored closely. Further, because banks’ proprietary funds often compete directly with funds offered by third-party managers, some managers (especially those that are in demand and have capacity constraints) may not accept allocations from the bank’s outsourcing clients.

Manager-of-Managers and Mutual Fund Complexes

Other outsourcing firms include multi-product/managers-of-managers and even some mutual fund complexes that repackage their services as "OCIO." These models trigger the same concerns as consultants and banks that offer "OCIO." In addition, these providers typically do not have significant alternative investment capabilities.

Also . . . Size Matters

Investment consultants, banks, managers-of-managers, and mutual fund complexes tend to be significantly larger than OCIOs, both in terms of number of clients and assets under management or advisement (AUM). We believe there is a “sweet spot” in size for outsourced services that the mid-size OCIO provider achieves. On the one hand, a larger AUM can allow an outsourced service provider to negotiate more competitive fees across the board for its clients, and a large pool of client assets can be beneficial for smaller clients that would otherwise be unable to meet manager account or subscription minimums. On the other hand, it is harder for an outsourced service provider with thousands of clients to provide personalized attention or consistent service quality. And for a consultant or manager with massive AUM, it can be difficult to find sufficient capacity in attractive, alternative investments or deliver alpha in the broader market. In effect, the largest players risk “becoming” the market and, thus, achieving index-like returns at a higher cost.

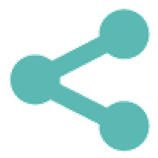

OCIO Services: What does an OCIO offer?

An OCIO provides a full range of customized front- and back-office services, including investment policy design, implementation, risk management, reporting, fiduciary education, and audit and tax support. The services are customized depending on each client’s needs, but the total package can include:

Governance and Guidance

- Advice on governance and fiduciary best practices

Investment Policy Development

- Collaboration to establish overall investment objectives, risk tolerance (including enterprise risk considerations), and liquidity needs

- Leadership on Investment Policy Statement creation (to establish allowable asset classes, create asset class target allocations, and identify permitted asset class ranges)

- SRI/ESG policy development, if desired

Portfolio Management

- Manager selection, monitoring, and termination (including transition activity)

- Distribution planning for non-profits/ liability-driven investment strategies for pension plans

- Cash management

- Overall portfolio tilts and tactical tilts within asset classes in response to valuation anomalies or opportunities

- Rebalancing for cash inflow and outflows or when investment parameters are triggered

Legacy Asset Oversight

- Monitoring and reporting on illiquid assets (e.g., private equity investments) acquired by the client prior to the OCIO relationship

Risk Management

- Investment due diligence – risk measurement and management

- Operational due diligence – review and monitoring of the corporate governance, operational processes, and controls of managers and vehicles

- Legal support – review, negotiation, and execution of manager and investment documentation

Stakeholder Communication

- Help communicating a client’s investment approach and portfolio status to its constituents (e.g., Board members, senior management, and donors)

Back-Office Resources

- Management of interactions with custodians and prime brokers related to investments

Technical Analysis and Reporting

- Full portfolio and performance reporting, including data aggregation and attribution analysis

- Reporting to support client’s finance department during audits

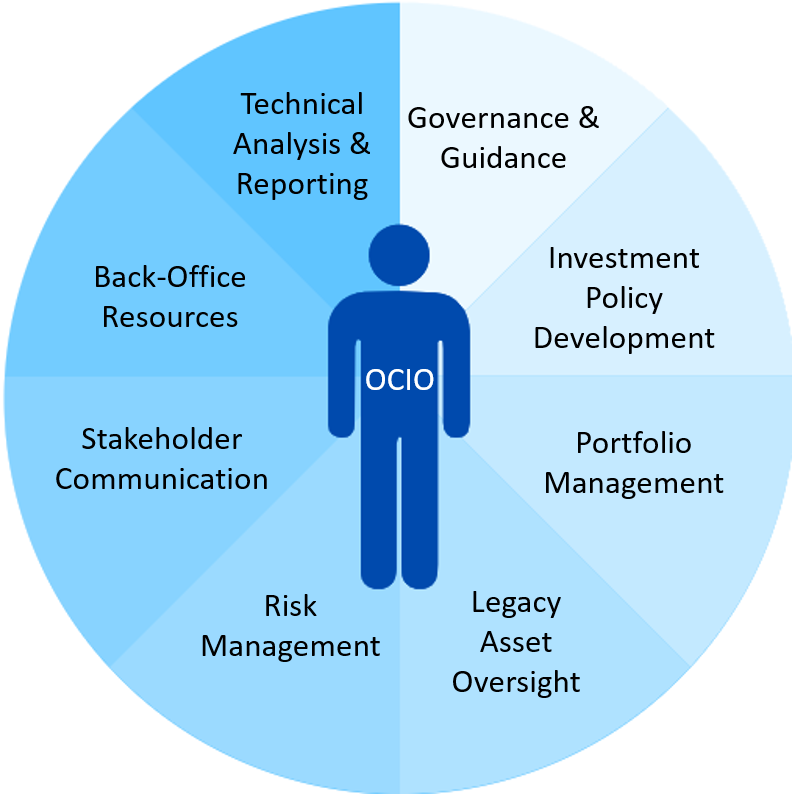

What the OCIO Relationship Means for the Organization’s Investment Committee

Investment Committee Responsibilities

An investment committee (or equivalent governing body) has various fiduciary duties with respect to the organization’s investment portfolio. The investment committee must:

- Establish a governance structure that identifies the roles and responsibilities of the members of the investment committee and other internal staff;

- Assess the organization’s ability to take risk (usually measured as an acceptable level of return volatility) given the purpose of the investment assets (e.g., covering operating costs for the organization’s core mission or meeting pension obligations) and the overall status of the organization's finances;

- Translate the return volatility into a strategic asset allocation for the organization’s investment assets;

- Develop an Investment Policy Statement that establishes permitted asset classes, creates a strategic asset allocation, and approves ranges for each asset class;

- Manage multiple third parties to help make and implement its investment decisions (e.g., consultants, managers, due diligence specialists, and custodians) and ensure that they adhere to agreed guidelines and targets;

- Review portfolio exposures and risk through tactical shifts and rebalancing;

- Monitor the performance of the portfolio;

- Review all fees and expenses related to the portfolio;

- Ensure compliance with legal and regulatory requirements (e.g., ERISA, CFTC, UPMIFA, and FOIA); and

- Communicate with other constituents (e.g., the Board of Directors, senior management, and donors).

Fulfilling all of these responsibilities requires technical expertise across numerous asset classes and strategies, significant analytical resources, and ample time to monitor all the service providers on an ongoing basis.

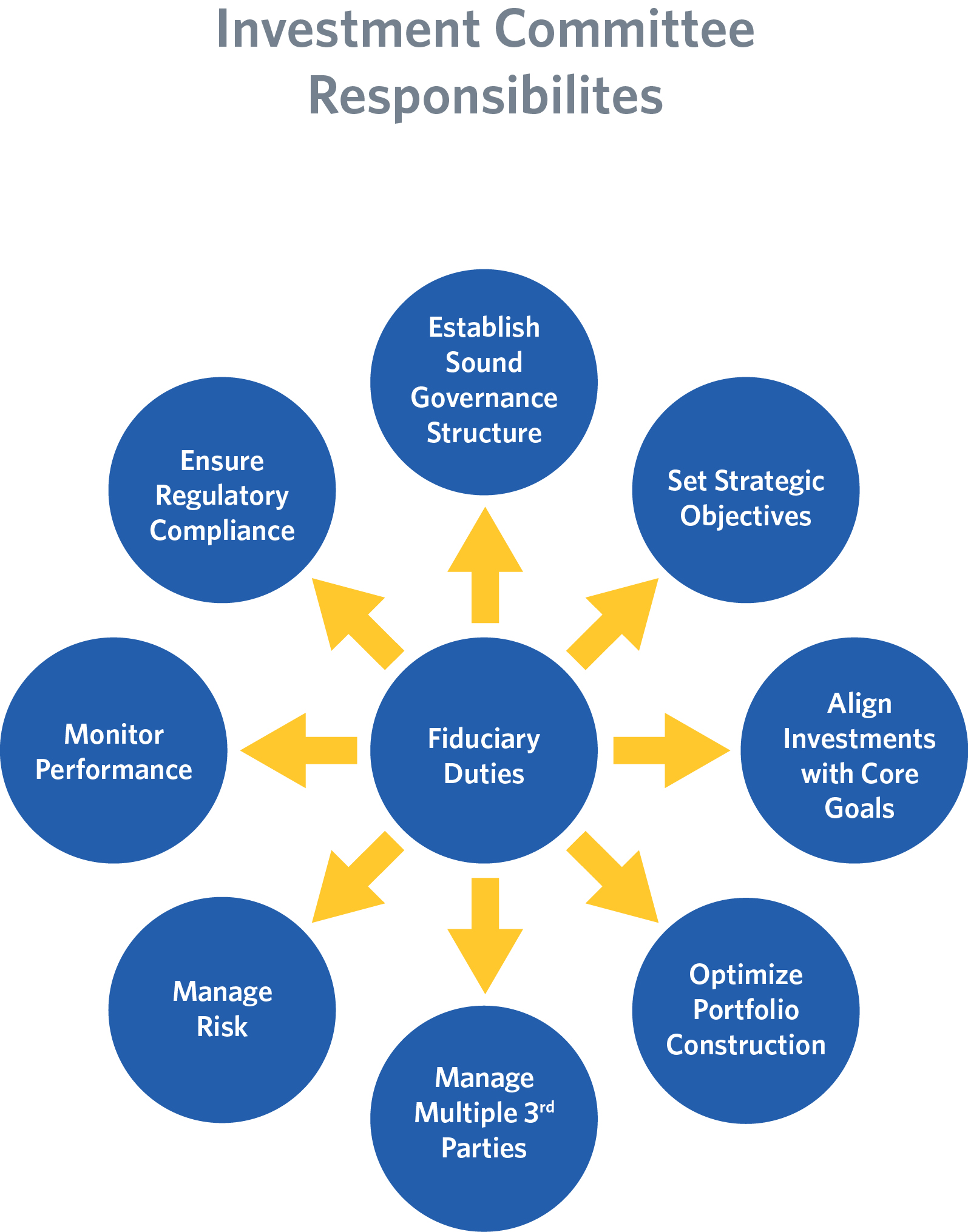

What Will Change if the Investment Committee Hires an OCIO?

An OCIO typically will assume responsibility for all the day-to-day tasks involved in managing the portfolio (shown below in teal). The investment committee’s responsibility for those tasks then shifts from direct action to oversight of the OCIO’s execution and performance of those tasks.

It’s important to understand that an investment committee cannot absolve itself of its fiduciary duties by hiring an OCIO. With the right co-fiduciary partner, however, the investment committee can spend less time hiring, monitoring, and firing managers, and more time on its essential roles of strategic direction and oversight.

Does Hiring an OCIO Mean the Investment Committee Loses Control?

Some investment committees fear they will lose control of the investment portfolio if they hire an OCIO; however, they fail to recognize the fundamental loss of control that is already occurring, because the investment committee is too distracted by the day-to-day minutiae of manager selection and monitoring to focus on the organization’s big picture goals. In fact, a good OCIO relationship can result in better effective control, by allowing the investment committee to concentrate its efforts on determining the optimal strategic direction for the portfolio and serving as a "second set of eyes" on the OCIO's implementation. Further, an investment committee does not have to give away more authority than it wants to, and it can always take back any delegated authority. It can keep meaningful control over the investment process in various targeted ways, including: creating lists of restricted securities, placing limits on allocations to certain assets classes, and establishing credit quality requirements.