Settle Into the New Dynamic

Once the OCIO transition is complete, the investment committee can focus on its essential roles of effective governance, strategic direction/goals alignment, and OCIO/portfolio oversight. Well-planned meetings with strategic agendas designed to address each of these roles will help ensure everything stays on track.

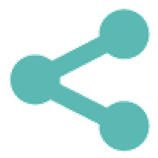

Congratulations! You have hired an OCIO and completed the transition process. What should the investment committee do now? To answer this question, let’s review the fiduciary duties of a typical investment committee and how those change when the organization hires an OCIO.

Partnering with an OCIO should feel like the organization has added a group of highly experienced team members to its ranks. As we have explained previously, in a typical OCIO partnership, the OCIO assumes responsibility for the day-to-day tasks involved in managing the organization’s portfolio (shown in teal in the chart below).

The OCIO takes a significant burden off the shoulders of the investment committee, and its responsibility for those tasks then shifts from direct action to supervision of the OCIO’s execution.

Ideally then, the answer to our question is for the investment committee to refocus its efforts on the remaining, higher-level duties (shown in the chart above in blue), namely to:

- establish and maintain a sound governance structure for the committee;

- periodically review the financial condition of the organization and confirm that the strategic (risk/reward) objectives for the investment portfolio are sufficient to support the organization and in alignment with its goals; and

- oversee the OCIO and monitor the performance of the portfolio.

We discuss below possible ways to address each of these duties in the context of an OCIO partnership. Also, to help ensure these duties are consistently performed, we propose a yearly rotation of agenda items for investment committee meetings.

Brush Up Governance

Good governance is critical both to a productive OCIO partnership and to meeting the organization’s overall investment objectives. The goal is a stable investment committee that understands its responsibilities, is capable of objective and nuanced thinking, and has defined objectives and processes.

To this end, at the completion of the OCIO transition process and thereafter on an annual basis, the investment committee should:

- Review the investment committee’s governing documents;

- Assess the committee’s membership and succession plan;

- Identify and review laws and regulations that apply to the committee’s actions and the management of the organization’s portfolio;

- Facilitate ongoing education for the committee members (as well as the board, internal staff, and other stakeholders); and

- Schedule and plan the framework of topics to be addressed in committee meetings.

Review Governing Documents: Charter and IPS

An investment committee’s governing documents typically consist of: (1) its charter and, in some cases, supplemental operating procedures (depending on the level of procedural detail already in the charter) and (2) the Investment Policy Statement. During the transition process, the investment committee will have revised the IPS together with the OCIO, so the next immediate step is to review the investment committee charter.

Investment Committee Charter

The charter should provide a reasonable framework for the operation of the investment committee that, at a minimum, establishes its:

- Purpose/Goals – The purpose of the investment committee generally will be to oversee the management of the organization’s overall investment portfolio or defined pool(s) of assets.

- Authority and Responsibilities – These will vary by organization (and this is not meant to be an exhaustive list), but investment committee powers generally include: access to relevant books and records, the vetting and appointment of committee members, the right to compel attendance at meetings by other stakeholders, and the ability to delegate certain responsibilities. Duties can include: the creation and review of the investment policy statement; the selection and monitoring of third-party advisers; the monitoring of investments and fees; the preparation of reports, disclosures, and forms; and the maintenance of relevant records.

- Membership – E.g., the number of members, the terms of their service, qualification requirements, compensation (if any), and the selection of a chairperson.

- Meeting Requirements – E.g., a minimum number of meetings, quorum and voting rules, and any specification of minutes and reports to the Board.

- Code of Conduct – A statement of the standards of behavior that apply to the committee members, including the duties of loyalty (to avoid conflicts of interest and act in the best interests of the organization), care (to be reasonably informed and act accordingly), and obedience (to act within the bounds of the governing documents, applicable laws, regulations, and agreements). If applicable, confidentiality requirements and other ethics rules also should be spelled out.

- Amendments – A statement of how the charter can be amended (this power is usually reserved to the full board).

- Decision-making Processes – Guidelines that determine:

- which decisions belong to the investment committee, and which are delegated to others;

- which committee members will be involved in particular decisions and in what capacities.

- what information is required for the various types of decisions; and

- who is responsible for providing the information.

In some cases, these guidelines will be built into the charter. In others (if permitted by the charter), the investment committee will adopt supplemental operating procedures.

The investment committee should determine whether the terms of the charter and any operating procedures are “working for” the investment committee and if the investment committee is in compliance with those terms. (These two issues are normally related.) If the details no longer serve the committee well, then the committee should discuss amending them (with the full board, if changes are required to the charter itself). If the details are good, but compliance is sloppy, now is the time to brush up!

Refine Membership and Succession Planning

The shift in roles and responsibilities prompted by a new OCIO relationship presents an opportunity to review the committee’s membership and make sure that a robust succession plan is in place. As noted above, the investment committee charter normally will establish the basic terms of membership, such as the size of the committee and the length of the members’ terms. In this regard, we believe that a reasonable committee size is between five to eight members, each of whom serves for a term of between three to five years on a staggered basis. It’s also a good idea, if possible, to maintain at least two members who were involved in the OCIO search for a few years to help preserve institutional memory of the considerations and qualities that motivated the selection of the OCIO.

Also consider the diversity and qualifications of the existing members as well as any positive and negative behavior dynamics that could be affected by altering the composition of the committee. For each member, you may wish to ask:

- Does the member have relevant financial experience? (In a committee of sufficient size, not all members need to have extensive financial knowledge, but each member should at least be able to understand the fundamental principles of portfolio management when explained and discussed.)

- Does the member have other qualities or skills that bring diversity of thought and experience to the committee?

- Is the member familiar with the strategic objectives of the portfolio and how they relate to the organization’s core goals?

- Does the member want to be on the committee?

- On balance, does the member have positive personal qualities (e.g., open-mindedness, inquisitiveness, organizational skills, confidence) that contribute to an effective team, or does the member have traits that detract from the group dynamic (e.g., overconfidence, dominance, poor listening skills, self-censorship).

Finally, be sure to have a succession plan that addresses both emergency and planned vacancies. The plan also should establish a process for recruiting and training new members (from both inside and outside the organization).

Address Applicable Laws, Regulations, and Agreements

Investment committees and the portfolios they manage typically are subject to various regulations, laws, and agreements, such as:

- State Uniform Prudent Management of Funds Act laws (adopted by most states) and public record laws (i.e., equivalents of the Freedom of Information Act (FOIA) on the state level);

- Federal laws and regulations (e.g., Section 4944 of the Internal Revenue Code for private foundations; ERISA in the case of certain pension plans); and

- Donor-imposed requirements.

We recommend having an attorney meet with the investment committee annually to refresh the committee’s understanding of these requirements (and train new members), discuss any changes from the prior year, and recommend ways to ensure compliance.

Promote Continuing Education

We also recommend that the investment committee keep abreast of industry trends and best practices being developed by similar organizations. This can be accomplished by sending members to attend conferences (e.g., events held by the Association of Governing Boards of Universities and Colleges) and report back to the committee, or by having members, the OCIO or staff read and present the highlights of relevant articles and other publications (e.g., the annual NACUBO-TIAA Study of Endowments).

Plan Ahead for Effective Committee Meetings

In our experience, the most effective investment committees establish an overall framework for their meetings in advance at the beginning of each fiscal year. This framework, broadly speaking, covers four major areas of investment committee responsibility (in the context of an OCIO relationship):

- Governance Matters

- Goals Alignment

- OCIO/Portfolio Review and Oversight

- Capital Markets and Asset Class Reviews

These topics can be distributed in a manageable way across the committee’s planned meetings for the year, which typically occur at least quarterly and on dates that are specified with ample notice to the members. We propose a strategic agenda below that breaks down these topics in more detail and suggests how they can be incorporated into an annual meeting cycle.

Focus on Strategic Objectives and Alignment with Core Goals

Before hiring an OCIO, many investment committees will have spent the bulk of their time hiring, monitoring, and firing individual managers. As a result, strategic objectives may be based more on intuition than actual financial data and quantitative analysis. With the services of an OCIO in place, the investment committee focuses on the metrics that affect the organization’s risk tolerance and strategic objectives.

Review Metrics

The key question for the committee to ask when reviewing the strategic objectives is: “Has anything changed or is anything expected to change in the near future that would affect the organization’s risk tolerance?” To answer this question, the investment committee should schedule meetings with and request reports from the board, senior management, and other stakeholders to make sure the committee is up to date on the organization’s finances. While the precise metrics will vary depending on the underlying goals of each organization, most investment committees will want to consider:

- projections of operating results;

- capital expenditure reports;

- details of planned new projects;

- anticipated contributions; and

- funding status.

These metrics, in turn, ideally will be expressed by the investment committee through five “tools” that together help set the organization’s strategic objectives:

- A Cashflow Projection – Expected contributions to and withdrawals from the portfolio.

- An Enterprise Risk Assessment – A probabilistic analysis of the potential impact of projected events on the organization’s goals.

- A Spending Policy – The rate at which the organization can spend based on its expected returns/asset allocation/organizational priorities.

- A Liquidity Profile – How much of the organization’s portfolio should be held in assets that are readily convertible to cash (without a significant price impact) to accommodate the spending policy.

- A Risk Profile – A statement of the levels of risk the organization can accept to meet its objectives.

A good OCIO also can help the investment committee refine these tools and use them to perform quantitative modeling under different asset class scenarios and market performance conditions.

Consider Goals Alignment and Values-Based Investing

The main goal of an organization’s investment portfolio is, of course, to provide adequate investment returns to fund the goals of the organization. In this sense, correctly assessing and meeting financial targets is the most important “alignment” for the investment committee to consider. Increasingly, however, many organizations want to incorporate “values-based” investment strategies into the management of their portfolios.

There are currently a variety of labels applied to these strategies that mean different things to different people, and can be confusing. These include: Impact Investing, Socially Responsible Investing (SRI); Environmental, Social, and Governance Investing (ESG); Diversity, Equity, and Inclusion Investing (DEI); and Sustainable Investing. However, the basic concept behind all these labels is the same: to deploy an organization’s investment portfolio in a way that both supports an organization’s core goals while also providing a benefit to society (or at least minimizing negative social effects). The investment committee may wish to explore whether there is any organizational interest in values-based investing. If so, the OCIO can work with the investment committee to identify the values that are most important to the organization and the best way to implement them.

Define Success

In conjunction with the periodic review of financial metrics and the organization’s overall goals and values-based initiatives, we recommend that investment committees establish a definition of “success” for their organization’s investment portfolio. Agreeing in advance what will constitute successful performance is important, because it creates a target around which to structure the portfolio’s asset allocation and also helps support investment discipline – particularly in times of market volatility. Success in the context of an organization’s investment portfolio typically is measured by two factors:

- the achievement of absolute returns relative to the organization’s objectives (e.g., meeting funding obligations, or generating adequate operating revenue), measured over 5+ year intervals; and

- the extent to which the portfolio has generated returns in excess of the policy benchmark identified in the organization’s IPS.

While it is clearly key that an OCIO deliver alpha, the following are also important factors to consider.

- Whether the investment policy benchmark has experienced greater volatility than the organization’s investment portfolio.

- How the investment portfolio has performed relative to peers – keeping in mind that other organizations have unique objectives and circumstances – over three-, five-, seven- and 10-year periods. (A one-year peer comparison is not meaningful, particularly during a period of significant performance dispersion between the best and worst-performing asset classes.)

- How the investment portfolio has performed over longer market cycles (e.g., five and ten years).

- How well the OCIO has managed fees compared to industry standards. Investment committees often overlook the extent to which high fees – particularly for strategies that do not have a high potential to add value to the portfolio – can eat into “net” returns.

A Note on Peer Universe Comparisons

While peer universe comparisons can be helpful in assessing the success of an organization’s returns, it’s important to keep in mind that:

- most peer data is self-reported in a highly competitive environment. Institutional reputations and, in some cases, the personal compensation of the individuals submitting the data, may affect the report;

- some reporting requirements are subject to interpretation and this ambiguity can cause organizations to report differently, leading to distortions in returns;

- an organization’s report may include returns from non-securitized investments (such as direct real estate holdings) that are not replicable by other institutions;

- the reporting of fees is not consistent. Commingled vehicles report returns net of fees, but most institutions show separate accounts gross of fees. Additionally, organizations with internal investment offices usually do not report returns net of the expense of the in-house team, whereas institutions that use an OCIO or outside advisor may report their information net of OCIO expenses;

- the reports do not reveal the level of risk assumed by an organization to achieve its return; and

- the number of institutions reporting (the sample size) and their similarity (or lack thereof) to other organizations can affect the relevance of comparisons.

Given these inherent limitations, a reasonable approach to the use of peer universe data is to treat it as one point of orientation in analyzing the success of an organization’s investment strategy. On the one hand, an investment committee should be aware of the performance of peer organizations and try to learn from them where possible. (If the organization underperforms perceived peers for an extended period of time, the investment committee will surely feel pressure from the organization’s stakeholders.) On the other hand, the investment committee will want carefully to assess whether the “peers” are comparable in terms of circumstances, resources, goals, and risk tolerance. In this regard, it is also helpful to understand that peer universe returns are dramatically influenced by asset allocation decisions (especially in periods when one asset class significantly outperforms). For this reason, we suggest looking at peer results over 5, 7, and 10 years to gain a better sense of skill. The overall goal is to be sufficiently informed to avoid making kneejerk decisions under pressure and to ensure that the decisions that are made adequately account for an organization’s unique situation.

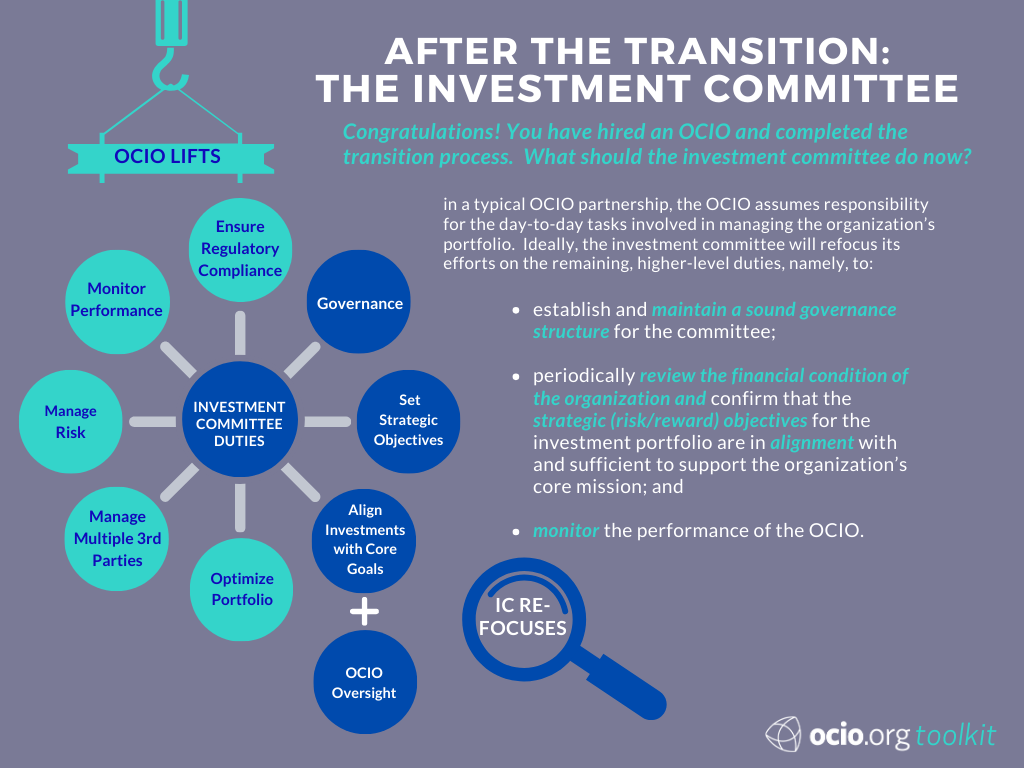

OCIOs and Values-Based Investing

Values-based investing seeks to align the investments made through an organization’s portfolio with its core goals or other values that the organization believes will have a positive social impact. Values-based investing offers exciting opportunities to support an organization’s goals, but it is an evolving approach that needs to be implemented carefully. A good OCIO can help an organization define and execute an overall investment program that helps integrate a values-based investment initiative with the organization’s overall objectives and financial needs. For additional information please see Chapter 4: Aligning Your Portfolio with your Mission in Endowment Management for Higher Education, Second Edition, published by the Association of Governing Boards of Universities and Colleges (AGB).

Identify Key Values and Goals

As a threshold matter, an organization interested in implementing values-based investing must be clear on which values (e.g., diversity, human rights, environmental stewardship, consumer protection, weapons reduction) to reflect in the portfolio and how they may be implemented based on the desired outcomes. While an OCIO can help facilitate and should be involved in any discussion of such “target values,” we recommend that the board of directors/trustees (or a committee of the board created specifically for this purpose) take the lead in the inquiry. The board’s stewardship will signal the importance of the values project and leverage the board’s unique knowledge of the organization and its experience working with the organization’s key stakeholders. At this stage, the OCIO guides the board through the process of identifying which values it wishes to express in the investment portfolio.

Understand Implementation Methods

The following are four main ways of implementing a values-based investment program. Because values-based investing is continuously evolving, different terms can sometimes be used to describe these methods.

- Negative Screening/Divestment: excluding categories of investment that conflict with the organization’s target values;

- Positive Screening: including categories of investments that are generally in alignment with the organization’s target values;

- Active Ownership or Engagement: proactively working with portfolio companies to encourage modifying their practices in line with the target values;

- Impact Investing: making investments that seek to achieve measurable positive social and/or environmental outcomes (similar to positive screening, but more focused and potentially more proactive).

An organization that is interested in values-based investing should look for an OCIO that has experience with these approaches (described in more detail below).

The negative screening/divestment method restricts (or sells existing) investments in companies that are engaged in “categories” of activities/industries that are opposed to the organization’s values. For example, an organization may decide to exclude from its portfolio companies that operate in the weapons, gambling, pornography, fossil fuels, alcohol, or tobacco industries. The organization also may choose to restrict investment in companies located or doing business in countries that engage in harmful activities such as human rights violations or environmental depredation.

To implement this approach, an OCIO will first look to an organization’s underlying managers to understand their ability to implement such screens. Additionally, an OCIO typically will hire a third-party data analytics provider to develop a customized “screen” for the organization as a check on all of the managers (or as a proxy for a manager that is unable/unwilling to do the required analysis). These providers comb through corporate disclosure statements and other databases to identify companies that generate a specified percentage of their revenues or profits in the particular industries or countries flagged. Because deliberate exclusion relies primarily on publicly available information and quantifiable metrics, it is the most straightforward approach to values-based investing and is relatively easy to implement. But it is also a primarily passive approach.

Positive screening effectively is the mirror image of negative screening. This method prioritizes investment of the organization’s portfolio in certain categories of activities or industries that are generally in alignment with the values of the organization. For example, an organization interested in environmental stewardship might look to invest in a manufacturing company that uses renewable energy sources or an agribusiness that employs sustainable farming practices. The process of implementation is the same as with negative screening, except that the screens are intended to identify companies for inclusion in the portfolio rather than exclusion.

Active ownership or engagement involves working directly with a portfolio company to modify its practices in line with the organization’s target values. This approach is often implemented in collaboration with other like-minded institutions. For example, some institutions have joined forces through investor networks such as Ceres to introduce shareholder resolutions related to the reduction of carbon emissions and otherwise engage the management of portfolio companies in initiatives related to target values.

Impact investing looks for investment opportunities in companies that exist specifically to promote or remove an obstacle to an organization’s values. Opportunities available for this approach often involve private equity investments in early-stage, innovative companies. For example, an organization that is concerned about climate change might invest (directly or through a pooled investment vehicle) in a company that is developing a novel carbon sequestration process. However, an organization also could invest in more established or publicly traded companies through activist investment funds that push those companies to comply with desirable practices that promote the organization’s values.

Determine Risk-Return Expectations

In addition to understanding the different implementation options, the board also must consider and come to an agreement on the organization’s risk-return expectations for its values-based investment program. Does the board expect that returns will remain competitive with or exceed relevant benchmarks, or is the board willing to make some investments for which financial returns are secondary? In this regard, an OCIO can help the board understand the likely implications of the methods the board is considering by modeling potential portfolio return scenarios under various market conditions.

It should be noted that one of the key benefits of an OCIO is that, as the client’s investment office, the OCIO has a view across the organization’s portfolio. (The depth of that view will vary by OCIO based on the transparency it demands from underlying managers and the OCIO’s own analytical tools.) An OCIO with a comprehensive view can employ risk mitigation, completion, and overlay strategies to help address any skew in the organization’s portfolio that may occur from values-based investment initiatives.

Revise Investment Policy Statement

Any change to the organization’s investment strategy to accommodate a values-based investment approach should be reflected in the organization’s investment policy statement. Here again, the OCIO can help the board determine any required adjustments to the organization’s strategic asset allocation plan (and, if necessary, its risk profile, and liquidity and spending policies). If, as we recommend, the OCIO has modeled return scenarios for the board, these models can be used to update the return expectations and performance measurement benchmarks in the investment policy statement.

Implementation

As noted above, an organization that is interested in values-based investing should look for an OCIO that has experience with the various methods of implementation. Some questions to ask an OCIO in this regard could include:

- Does the OCIO track if and how each of its managers employs values-based factors in the investment process?

- Does the OCIO have arrangements with one or more analytics firms to perform screens?

- Has the OCIO implemented screens for investors in the past, and, if so, what type?

- Does the OCIO have deep relationships with private equity firms or other forms of access to private investment channels that focus on impact investing?

Monitoring

We recommend the board conduct an overall review of its values-based investment program on at least an annual basis (ideally as a specific agenda item in the context of a regular board meeting). This review should have three components: (1) a review of the goals the organization set out to accomplish with its value-based investment program; (2) an analysis of whether those goals were achieved; and (3) the effect (if any) on the performance of the organization’s portfolio. In this regard, some useful questions for the board to consider are:

- Have there been any changes within the organization or in the investment marketplace that suggest changing the implementation method(s)?

- In the case of screens, what metrics are being used to determine inclusion/exclusion, and are they having the desired effect?

- How is alignment with the organization’s target values measured in the case of private equity investments (e.g., mandatory regulatory disclosures, voluntary self-disclosures, and/or adherence to recognized industry standards such as the Principles for Responsible Investment (PRI), The Walker Guidelines, and the UK Stewardship Code)?

- Are the returns of the program in line with the parameters established in the investment policy statement?

OCIO Oversight and Portfolio Review

An investment committee and its partner OCIO are co-fiduciaries. This means that, although an investment committee can delegate the implementation of the organization’s investment strategy to the OCIO, the investment committee retains a legal (fiduciary) responsibility for the management of the portfolio. In the context of an OCIO relationship, the investment committee generally will be considered to have fulfilled this responsibility by adequately monitoring the OCIO’s services and portfolio performance. This does not mean that the investment committee needs to scrutinize every decision made by the OCIO or fire the OCIO at the first sign of underperformance; rather, the investment committee needs to confirm that the OCIO is performing its duties in a skilled and professional manner overall. Regular reviews, that typically happen through quarterly meetings, are a critical component of this ongoing oversight. Some investment committees handle all of the tasks associated with monitoring the OCIO, while others get help with the process, either from internal staff of the organization or from a third-party service provider that specializes in OCIO oversight.

In addition, performance does not occur in a vacuum. Therefore, as a precondition to monitoring the OCIO and the portfolio, the investment committee also needs to stay up to date on prevailing market conditions and understand the role that each asset class is meant to serve in managing the overall risk profile of the investment portfolio.

Adherence to IPS, Performance Review, and Capital Markets Analysis

The overall requirements of investment committee oversight are, in broad terms, to confirm that: (1) the OCIO is operating within the bounds of the Investment Policy Statement and its fiduciary duties generally; and (2) the performance of the portfolio is reasonable given the investment style and strategy employed by the OCIO and the overall market conditions during the period in which performance is being reviewed. To this effect, an investment committee should, on a quarterly basis:

- Assess Possible OCIO Conflicts – Inquire whether anything has changed with respect to the business model of the OCIO that could give rise to a conflict of interest in its management of the portfolio or otherwise compromise the OCIO’s fiduciary duty to the organization. (Note, in this regard, that a true OCIO seeks to minimize potential conflicts by maintaining a sole focus on OCIO to the exclusion of other business lines and by not receiving any compensation from other service providers to the organization’s portfolio.)

- Check for Key Portfolio Changes – Determine whether there have been any changes since the previous quarter to:

- underlying managers,

- investment strategy(ies),

- asset allocation,

- risk profile,

- liquidity,

- exposures, or

- other specified guidelines,

and require the OCIO to demonstrate any such changes remain consistent with the terms of the IPS and that they are consistent with the overall investment process that was the basis for the OCIO’s hiring.

- Compare Performance Against Reference Points – Review the investment performance and attribution of the organization’s portfolio compared to:

- targets,

- appropriate benchmark(s),

- the performance of peer organizations, and

- the performance of the capital markets generally and specific relevant asset classes during the same period.

- Review Fees and Expenses – Confirm that the fees and related expenses charged to the portfolio for the period are warranted and reasonable.

In addition, on an annual basis, we recommend that the investment committee work with the OCIO on the following actions.

- Portfolio Risk Analysis and Stress Testing – to assess how the portfolio would perform under various potential market scenarios.

- Benchmark Review – to confirm that the benchmark(s) being used to measure portfolio performance are still appropriate.

- Revision of Long-term Asset Allocation – to incorporate market conditions from the previous year.

- “Deep Dive” Asset Class Reviews – to allow for deeper understanding of the various asset class components of the portfolio and focus on market conditions specific to each.

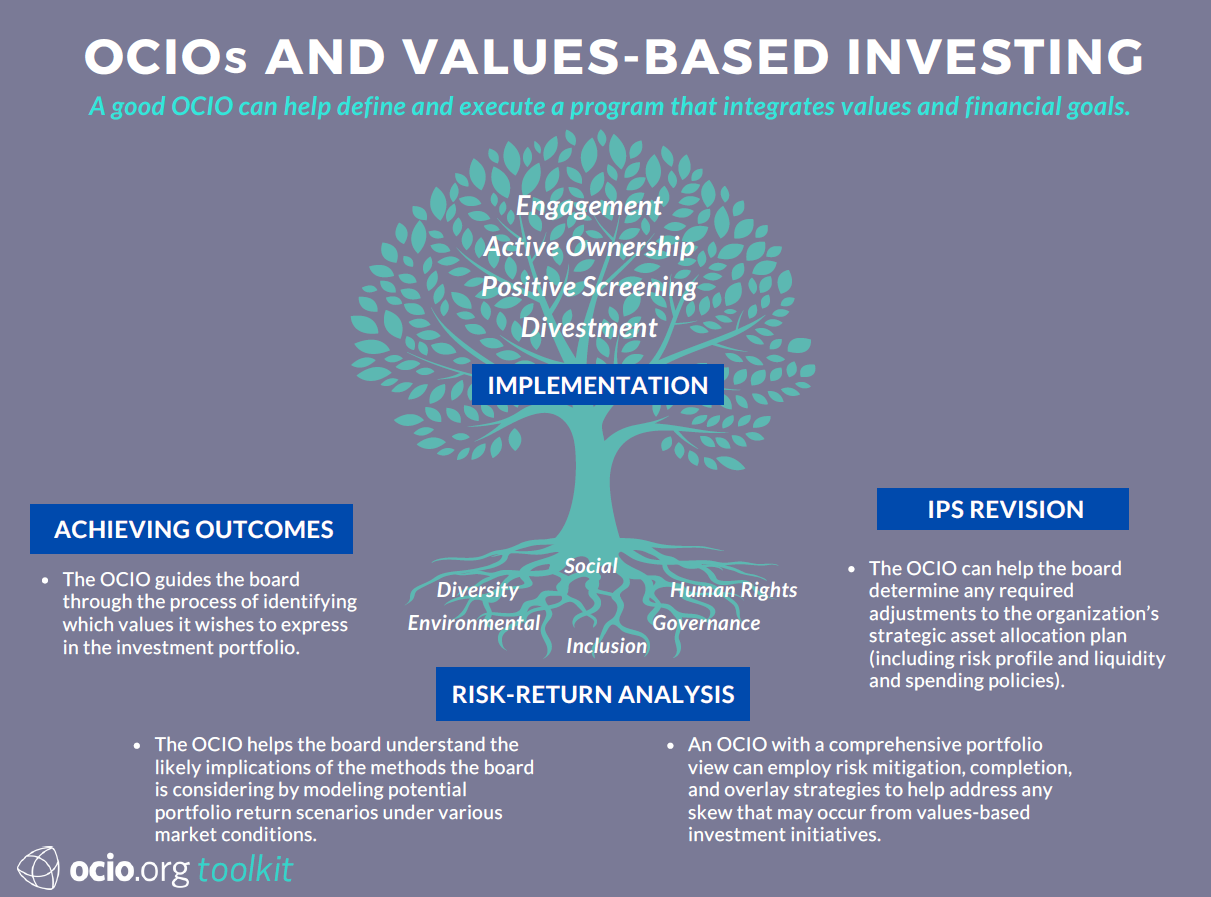

What's on the Agenda?

After reading the discussion of investment committee responsibilities and recommended best practices listed above, it may seem like keeping on top of them all is a daunting project. Keep in mind, however, that not every responsibility needs to be addressed with the same frequency, and that a good OCIO will provide much of the required performance information as a matter of course (and can be asked – with sufficient advance notice – to participate in ad hoc reviews or prepare specialized reports to assist the investment committee). By planning the committee’s agendas in advance with a year-long time horizon and spreading tasks among the various committee members (who, in turn, may be assisted by internal staff, and/or an outside OCIO monitoring specialist) it’s possible to design an overall investment committee program that is both comprehensive and manageable.

In the chart below, we break down the investment committee’s responsibilities in the context of an OCIO relationship into four main areas. Then we distribute the underlying components of each area among four quarterly meetings.

Quarterly Agenda Items

The following items are of critical importance and should be undertaken each quarter:

- Performance Review

- IPS Adherence

- Market Update/Outlook

- Asset Class Review – focusing on a different asset class each quarter.

In addition, as a matter of governance “hygiene,” each meeting should begin with the approval of the prior quarter’s minutes.

Periodic Agenda Items

- Investment Committee Education – We recommend that at least two quarterly meetings involve an educational component to help ensure that the investment committee members remain current with regulatory requirements and investment trends.

- Report to the Board of Directors – Similarly, we recommend a report to the full board twice a year to ensure adequate two-way communication and updates.

- Joint Finance and Investment Committee meeting – If there is not significant overlap of the Finance and Investment committees, we also recommend one joint meeting of these committees each year.

Annual Agenda Items

For the remaining items, a single review during the course of the year is generally sufficient. It makes sense to address certain items at the end of the organization’s fiscal year (described as “Q4”), but for the rest, there is no specific timing requirement. We simply suggest the following timing as one reasonable way of fitting the pieces together.

Q1

- IPS, Charter and Succession Plan Review

- Liquidity Profile Update

- Spending/Distribution Policy Update

Q2

- Applicable Laws Review

- Enterprise Risk Assessment

- Portfolio Risk Analysis/Stress Testing

- Risk Profile Update

Q3

- Treasurer’s Report

- Review Investment Philosophy/Values-Based Concerns

Q4

- Fiscal Year End (FYE) Goals – Review and Reset

- Long-Term Capital Markets Assumptions Update

- Long-Term Asset Allocation Update

- Senior Management Report

- Cashflow Review (Expected Inflows/Outflows)

- Annual OCIO Review

- Investment Committee Membership Appointments

- Creation of Next FYE Calendar