What to Know Before You Go OCIO

We break this down into two steps.

First: Understand the OCIO landscape. Learn about key aspects of the OCIO business model and how they differ among OCIO firms. Consider the “chemistry” created by an OCIO’s size, team, and culture.

Then: Understand what you want in an OCIO. Assess your organization’s goals, needs, and preferences. Decide what’s working, what could be improved, and what you want in an OCIO.

Step One: Understanding the OCIO Landscape. Not all OCIOs are the same.

OCIOs have different investment philosophies, ways of deploying client assets, and operational/ back-office capabilities. Fee disclosure and performance reporting also vary greatly among OCIO providers, due to a lack of uniform standards across the industry. And, crucially, OCIOs have different values and convictions about how best to provide OCIO services.

How, then, can an organization choose among providers?

The solution is to be an educated consumer and demand transparency. Ultimately, an organization is best able to choose the right OCIO provider when it has meaningful and comprehensive information.

In terms of education, many factors are important when selecting an OCIO, but it helps to have a solid understanding of the following key areas:

- Investment philosophy and process

- Implementation systems

- Treatment of “legacy assets"

- Operations and back-office capabilities

- Fees

- Performance

It’s also essential to notice factors that can affect the “chemistry” of OCIO-client relationships, such as the size of the OCIO's staff; how many clients the OCIO has and the amount of assets under management; the company culture; and the experience and demeanor of the OCIO's team.

Investment Philosophy and Process: OCIO and client alignment is critical.

Just like all asset managers, OCIOs have different investment philosophies. Some favor passive investment strategies, for example, while others believe in active management but may emphasize value, fundamentals, growth, or technicals.

Some investment committees also have strongly held views on which investment philosophy best suits their organization’s needs and objectives. In our experience, however, a surprising number of investment committees haven’t discussed (internally) or come to an agreement on the best investment philosophy for their organization. These investment committees also may neglect to discuss investment philosophy with their OCIOs before hiring them.

Make no mistake: if a client and an OCIO are not on the same page with respect to investment philosophy, the relationship will not work. Also – if a client is looking for specialized investment considerations such as ESG (focused on environmental, social, and corporate governance), DEI (focused on diversity, equity, and inclusion), or LDI (liability-driven investing), the time to ask whether the OCIO can accommodate these approaches is before signing an agreement.

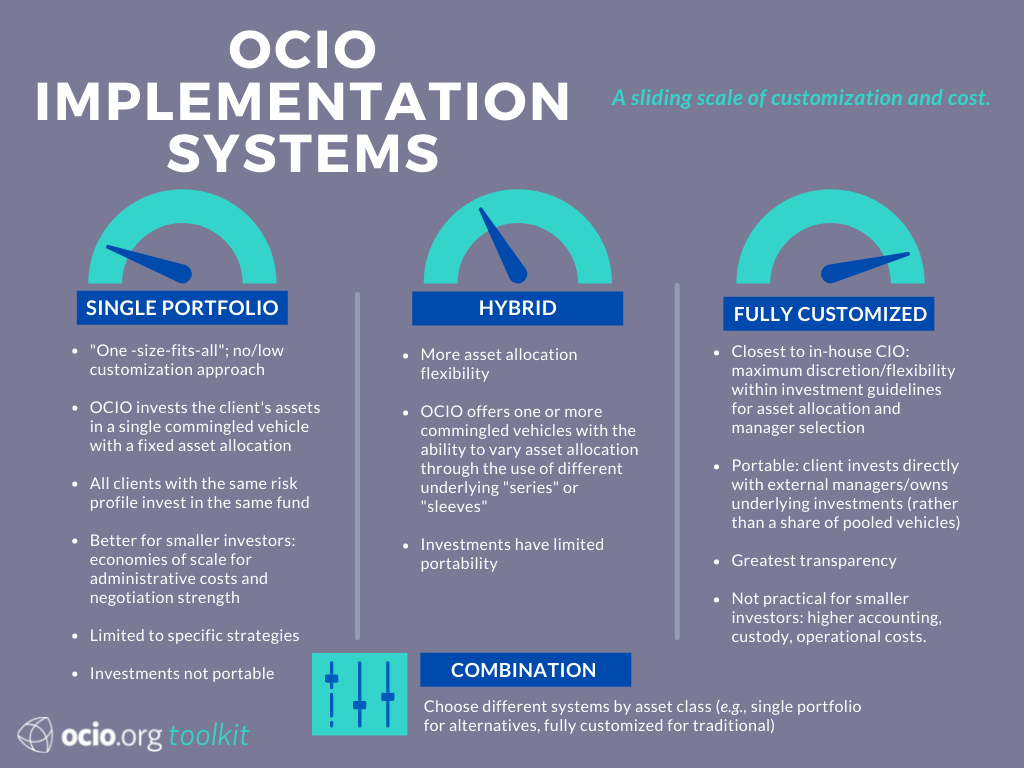

Implementation Systems: A sliding scale of customization and cost.

OCIOs offer different “implementation systems” (i.e., ways of deploying client assets) that vary from least to most customized as follows: Single Portfolio (Fund), Hybrid, and Fully Customized. Some OCIOs offer only one of these systems, whereas others may offer multiple systems to accommodate clients of different sizes and that have different investment objectives.

In this system, the OCIO invests the client’s assets in a single fund that has a fixed asset allocation and risk profile. This is the least customized option, because all investors with a similar risk profile are invested in the same fund (and, therefore, in the same managers/underlying investments). There is no ability to vary the client’s underlying manager or investment lineup.

This system is the most economical and could be an attractive option for a smaller client (e.g., typically a client with assets under $100 million) with straightforward investment objectives, because the expenses of a single fund are low and distributed among the shareholders. In addition, aggregating a client’s assets with those of other investors could increase overall negotiating power with respect to manager fees. For an OCIO that offers multiple implementation systems, another benefit to smaller investors of the Single Portfolio system is that they get access to the same managers as the OCIO’s larger clients. (In effect, the fund is treated like a single, large client for purposes of allocation among the OCIO’s other clients.)

However, it’s important to consider what will happen if the OCIO relationship is terminated. The investment committee will want to find out whether there are any back-end fees or limits on redemption from the fund. This investment committee also should understand that the fund's underlying investments likely are not portable.

In the Hybrid system, the OCIO invests the client’s assets in a fund that has separate “sleeves” dedicated to particular asset classes or in a series fund (an umbrella-like structure with multiple underlying funds). The OCIO can vary the asset allocation of each client as needed – both at the outset of the relationship and over time – by adjusting the amount invested by the client in each sleeve or series. Here again, customization at the underlying manager or security level is not possible, however, because each investor in a sleeve/series will share an interest in all the securities held by the sleeve/series. Like the Single Portfolio system, this Hybrid system offers cost-spreading, aggregation, and manager access advantages, but also a greater degree of customization at the asset allocation level. The same redemption and portability concerns also apply.

The Fully Customized system is most similar to the way an internal chief investment officer operates; the OCIO invests some or all of a client’s assets directly with various managers in a wide variety of asset classes (either by opening a separate account for the client with each manager and/or investing the client’s assets directly in the manager’s pooled vehicles). In this way, both manager selection and asset allocation can be tailored to the specific, ongoing needs of the client. This approach is most appropriate for larger clients who can meet the separate account and fund investment minimums often imposed by managers, and who can afford higher custody, accounting, and operational costs.

In some cases, an OCIO may offer a combination of separate accounts for traditional investments and pooled vehicles (i.e., a fund-of-funds) for alternative investments. This approach may be an attractive option for a client that is large enough to meet separate account minimums for traditional asset classes but too small to meet minimums or achieve adequate diversification for alternative investments. A fund-of funds also can be a way of offering clients access to otherwise closed managers.

Remember

Regardless of the implementation system, a true OCIO selects managers through an “open architecture” process (i.e., the OCIO searches for best-in-class managers) and does not have any incentive to allocate client assets to particular managers with which it has revenue-generating arrangements.

Legacy Assets: What will happen to the organization's existing investments?

It’s important to understand how an OCIO will handle the organization’s existing investments – commonly referred to as “legacy assets.” An OCIO understandably will want to sell any marketable securities in the organization's existing portfolio that do not match its asset allocation strategy or meet its manager quality determinations. However, the sale of a large portion (or all) of an organization's liquid assets by an OCIO likely will result in significant transaction costs and perhaps even losses if the assets are not sold into the market carefully.

Illiquid Holdings: Private Equity, Real Estate, and Hedge Funds. Also be sure to discuss how an OCIO will manage any non-marketable/illiquid assets in the existing portfolio, such as private equity, real estate, and hedge funds. In our experience, leaving these investments “orphaned” is not an option.

If an organization holds these illiquid assets through another outsourcing provider's fund-of-funds structure, that provider will continue to be responsible for any ongoing requirements associated with the underlying investments. In that case, there is not much for a new OCIO to do, except to report on the performance of the fund-of-funds as a component of the organization's overall portfolio, manage cashflows to meet any unpaid commitments, and take the fund-of-funds exposure into account when building out the rest of the portfolio.

However, if the organization owns direct interests in private equity, real estate, or hedge funds, then someone will have to actively administer those investments. In the case of hedge funds, that could mean performing ongoing due diligence on the manager and its fund operations, looking for secondary market sales opportunities if there is a lockup, or otherwise determining an appropriate time to redeem. Private equity funds also require ongoing due diligence on the manager, its fund operations, and any secondary market sales opportunities. In addition, someone also must be responsible for: managing capital calls and distributions; voting on matters affecting the fund (in the organization's capacity as a shareholder or limited partner); overseeing compliance with side letter terms; and, for certain tax-exempt and non-US clients, deciding whether to elect the use of tax-advantaged blockers or alternative investment vehicles when available for investment in particular portfolio companies. And there is also the possibility that a private equity fund may need to be terminated early or the managers removed for malfeasance or other management problems.

Finally, if the OCIO will be making additional illiquid investments in the organization's portfolio, the investment committee should explore how those investments will be handled if it ever decides to terminate the OCIO relationship, and whether the OCIO will assess any fees for their ongoing management.

Operations and Back-Office Capabilities: Not all OCIOs have the same operations and back-office capabilities.

It’s natural to focus on an OCIO’s core portfolio management services, but operations and back-office capabilities are also critical and complex. An OCIO may provide some or all of these services in varying combinations and with different levels of expertise.

Operations. An operations department is responsible for:

- Trade processing – ensuring that all transactions are properly completed and recorded with counterparties;

- Reconciliation – confirming that the client’s custodian agrees with the OCIO's records on which investments are in the organization's portfolio and how much cash is available for deployment; and

- Valuation – keeping track of how much the components of the portfolio are worth at any given time.

Back Office. Back-office functions include:

- Monitoring performance;

- Accounting;

- Cash-flow management;

- Recordkeeping;

- Tax and audit support;

- Legal risk management (i.e., implementation of internal legal and compliance procedures; and review, negotiation, and execution of legal agreements related to client investments); and

- Operational due diligence – to assess possible risks presented by managers in the portfolio.

Key Factors. Some factors to consider when comparing OCIO operations and back-office capabilities:

Dedicated and experienced operations staff. Consider whether an OCIO has staff members that are dedicated to the operations and back-office functions. Look at their experience as well as how many staff members are assigned to the department in light of the number of client accounts the OCIO handles.

Frequency of reconciliation and valuation. Reconciliation and valuation are critical to obtain desired exposure, minimize cash drag and rebalancing errors, and to be able to respond quickly to market movements. In general, transactions and cash should be reconciled daily and portfolio holdings should be reconciled at least weekly. Portfolios should be valued daily.

Technology. Find out what technology the OCIO uses. Is it still performing any functions manually? Does it have backup systems in case of outages and disaster recovery plans? Does the OCIO have a robust cybersecurity program?

Control procedures. An OCIO should have robust control procedures to help detect and prevent errors and fraud. Some OCIOs also conduct formal internal audits of their financial reporting control procedures that help confirm whether the controls are effective (e.g., an SSAE-16 examination or full SOC -1 Type I and Type II report). While these formal audits are not yet common, they are a sign that an OCIO values the protection of client accounts and is willing to subject its internal processes to review and improvement.

Relationships. Back office staff should be experienced in managing relationships with a client's internal staff, investment managers, actuaries, auditors, custodians, and other service providers.

Outsourcing. Ask whether the OCIO outsources any operations, back-office, or compliance functions. This could create a vulnerability for client accounts if the outsourcing relationship runs into difficulties. You also will want to know if the OCIO is outsourcing to any affiliates and whether it is receiving a referral fee or kickback for doing so.

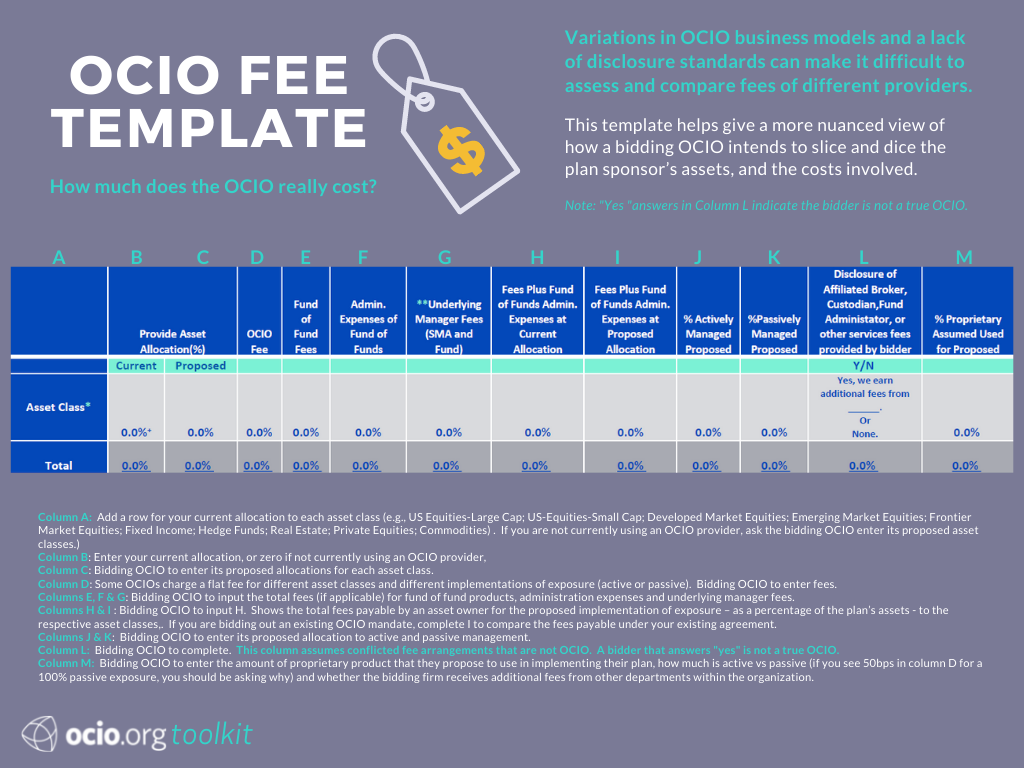

Fees: Variations in OCIO business models and a lack of disclosure standards make it difficult to assess and compare fees.

On the surface, quoted OCIO fees appear straightforward. The two most common types of fee structures are an asset-based fee (typically quoted in basis points as a percentage of assets under management) and an asset-based plus performance fee (an asset-based fee plus a participation in the excess performance above a predetermined hurdle).

Dig a little deeper, however, and reviewing fees can seem like a game of “Find the Differences.”

Despite the difficulty, understanding OCIO fees is well worth the effort: it makes a “difference” to the organization's bargaining position and satisfaction. We offer some suggestions on where to direct your attention:

Track record and service. In many areas of life, you get what you pay for, and OCIO is no exception. An OCIO’s fees typically reflect the firm’s history of delivering performance for clients and its service level. A boutique OCIO firm that has delivered strong returns for clients and limits the number of clients it accepts (to provide access to capacity-constrained managers and deliver dedicated and personalized service) will cost more than a very large firm with hundreds of clients and a track record that has not provided alpha.

Disparate investment strategies. Consider the quoted fee in the context of the investment strategies offered by the OCIO and its proposed allocations to each asset class. A low fee may not include much more than passive management, or little to no expertise or capacity with respect to alternative assets.

Degrees of discretion. OCIOs generally charge more for greater levels of discretion. Confirm how much responsibility – and accountability – is included in the quoted fee.

Fees for different asset classes. Some OCIO firms charge a single comprehensive fee that includes all asset classes, whereas others charge a different fee for each asset class they oversee. (Note that, in the latter case, if the OCIO also has discretion over asset class allocation, the OCIO has an incentive to steer client investments to those asset classes that generate higher fees.)

Performance fee calculations. Look behind the percentage quoted. How is the performance fee being calculated? Is it based on the total increase in NAV? Is it adjusted for management fees? If it is based on a benchmark, which one? Does the benchmark align with the risk level of the organization's portfolio? Try to assess whether the OCIO will be properly motivated by a performance fee or encouraged to take inappropriate risks.

Compare customization. Which model of implementation (single fund, hybrid, or fully customized) is the OCIO offering for the quoted fee? A more customized approach understandably will cost more to provide.

What services are provided? Know what’s included in the quoted fee. Not all OCIOs provide the same services. Also, some OCIOs provide quotes that include all of their services, whereas others include core services only (asset allocation, manager selection, and oversight) and charge extra for certain services (e.g., custody, travel to investment committee meetings, transaction fees, reporting, etc.).

Bundled vs. unbundled manager fees. Sometimes, the OCIO’s fee is “bundled,” meaning that the OCIO pays all underlying manager fees out of its own fee. Other OCIOs separate or “unbundle” manager fees from their own. (Consider that bundling may encourage an OCIO to hold down manager fees, even at the expense of potential value added by a manager that justifiably charges a higher fee.)

Redemption/back-end fees. It may seem odd to think about the end of a relationship before it even begins, but it’s important to know whether the organization will be subject to any redemption or back-end fees if the organization terminates the OCIO relationship. (Not only do these fees effectively add to the bottom line of what the OCIO actually costs, but they may cause the investment committee to extend the relationship longer than it otherwise would.)

Fees for legacy assets. Ask whether there will be any additional fees or transaction costs associated with managing existing investments. There is no industry consensus on fee structures for legacy assets, but some approaches include:

- No Fee – The OCIO does not charge a fee for managing illiquid legacy assets. (Note that managers who do not charge a fee for legacy assets typically will not provide any meaningful services in this regard.)

- Discounted Fee – The OCIO manages the assets at a discount to its percentage of AUM rate.

- Full Charge – The OCIO includes the assets in its calculation of client AUM for purposes of assessing its fee.

Guarantees. Some OCIOs will offer a “most-favored-nation” assurance with respect to their fees. This provides comfort that the OCIO will not charge another client a lower fee for similar services. It is also worth inquiring if the OCIO guarantees its quoted fee schedule for a certain period of time.

Maybe it’s not OCIO. A quoted fee may be low because the provider is supplementing its compensation through revenue-sharing arrangements with the managers and service providers it selects for client portfolios. An outsourcing provider that participates in these types of conflicted fee arrangements is not an OCIO. If an investment committee is considering a non-OCIO provider that receives supplemental income in this way, the committee should ask the provider to disclose its direct or imputed share of any affiliated service provider’s fees, and then add that share to the fee quote.

Also – if an investment committee hires such a provider, it should be prepared to spend a significant amount of time supervising the provider to make sure it has and complies with reasonable conflict of interest policies, and that its manager selections do not favor the provider’s bottom line over the organization’s performance results.

As the above analysis demonstrates, there are many variables and features to keep in mind when comparing outsourcing providers. Requesting that fees be presented according to this template can make it easier to cut through the confusion.

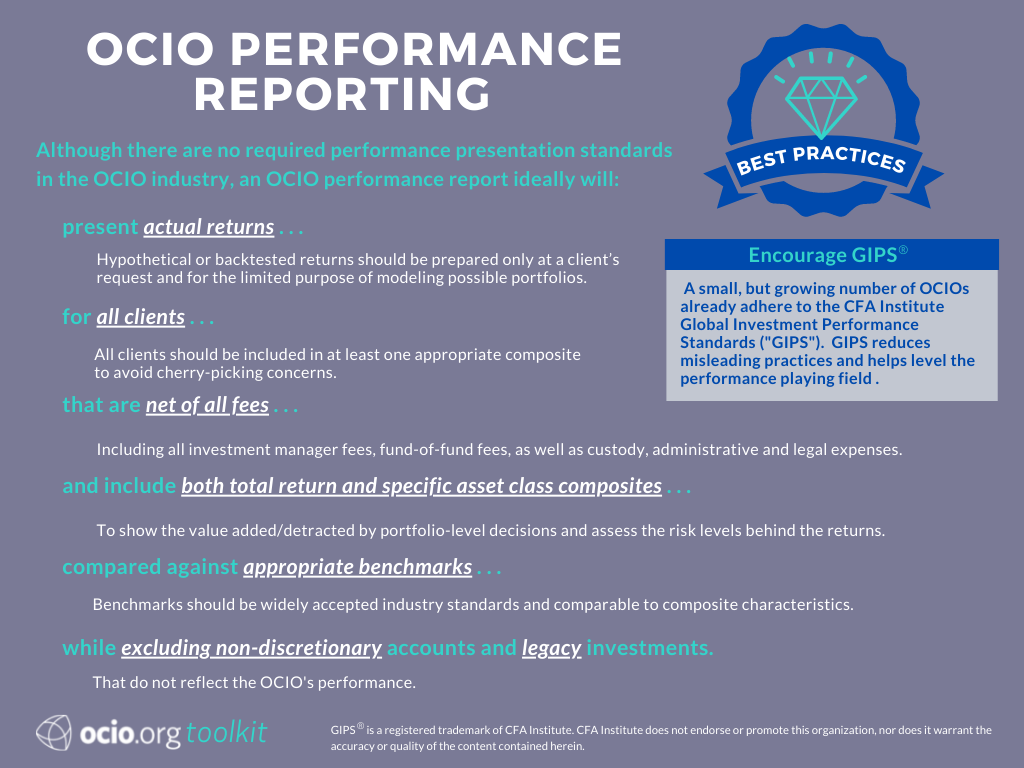

Performance Reporting: There also is no single, widely accepted set of performance reporting standards in the OCIO industry.

Performance reporting varies widely among OCIOs for many of the same reasons that fee structures and disclosures vary:

- Organizations have different investment objectives and restrictions, and they grant OCIOs varying degrees of discretion; and

- OCIOs implement client portfolios across multiple asset classes through delivery systems with varying levels of customization and different fee structures.

Best practice standards for performance reporting still need to be established. A growing number of OCIOs already adhere to the CFA Institute Global Investment Performance Standards ("GIPS®"); however, GIPS does not yet fully level the performance playing field for purposes of comparison among OCIOs (see GIPS discussion below). In the meantime, clients can empower themselves by being familiar with best practices and asking for performance data in a format that helps clarify whether these practices are being followed.

And don’t neglect to read the footnotes! No matter how boring, the investment committee needs to dig deep and read the fine print. Footnotes explain the practices and reporting policies employed by the OCIO and disclose additional information that isn’t shown in the main performance tables.

Best Practices in Performance Reporting

The best OCIO performance reports are those that contain real and comprehensive data, presented in a straightforward manner that allows for uncomplicated comparisons. The following practices are essential (and, in our opinion, non-negotiable):

Presentation of actual returns. An OCIO should present returns from actual client accounts. Confirm with the OCIO that this is the case. When there are legitimate reasons to present hypothetical and backtested returns, they should be offered in addition to actual returns and marked clearly as hypothetical/backtested. (Also, read the footnotes carefully for detail!)

Inclusion of all client accounts. All clients should be included in at least one appropriate composite to avoid cherry-picking concerns.

Presentation of performance net of all fees. There are reasons to present gross fees and this is fine if properly disclosed. However, an OCIO also should present returns that are net of OCIO fees and all other management and administrative expenses. That includes all investment manager and fund-of-fund fees, as well as custody, administrative and legal expenses.

Inclusion of both total return and specific asset class composites. The problem with total return histories is that it often is not possible to assess the level of risk undertaken to generate the returns. Asset class returns can improve visibility into the investment process – provided that they are sufficiently granular (e.g., a single “equity” composite is not as helpful as separate U.S. and non-U.S. equity composites). However, asset class returns do not show the value added or detracted by portfolio-level decisions, such as tactical allocations between asset classes. Having both total return and asset class composites gives a more complete picture of an OCIO’s performance.

Use of appropriate benchmarks for comparison purposes. There are widely recognized benchmarks for each asset class that are considered industry standards because of their representativeness, investability, and transparency. Confirm that the characteristics of the benchmark used by an OCIO are comparable to those of the composite being presented.

Exclusion of non-discretionary accounts and legacy investments. Accounts over which an OCIO does not have discretion, and investments that an OCIO did not select, do not accurately reflect its performance.

Insist on performance information that hits all of these key requirements.

GIPS Performance Reporting and OCIOs

The CFA Institute Global Investment Performance Standards ("GIPS®") are ethical standards for the calculation and reporting if investment performance based on the principles of fair representation and full disclosure. GIPS has long been considered the industry “gold standard” for performance presentation outside of the OCIO industry and has been adopted by hundreds of direct asset managers around the world, including most of the top, direct asset management firms. A growing number of OCIOs also adhere to GIPS. We think this is a step in the right direction, because in order to claim GIPS compliance, an OCIO must at least present its performance in an internally consistent manner and provide a baseline level of transparency in reporting. It’s important to note, however, that because OCIOs use different implementation approaches, even GIPS compliance does not mean perfect comparisons between OCIO providers is possible. For example, in order to claim GIPS compliance:

- An OCIO must ensure it has satisfied all applicable requirements of the GIPS standards. These standards govern input data, calculation methodology, composite construction, disclosure, presentation, and reporting. Further, specific requirements apply to private market investments (e.g., real estate, private equity), pooled funds, and separately managed accounts.

- Caveat: GIPS standards don’t require one single composite definition or the use of specific benchmarks. When comparing OCIO performance, note how the firm has defined their composite and which benchmarks each OCIO is using paying close attention to the benchmark characteristics.

- All actual, discretionary, and fee-paying client accounts must be included in at least one composite defined by objective strategy or mandate.

- Caveat: GIPS does not define discretion but requires each firm to create their own definition. How firms handle legacy assets is important and could vary among firms. Make sure you ask for each OCIO’s definition of discretion.

- An OCIO must document the internal policies and procedures used to establish and maintain GIPS compliance, and internal compliance audits are strongly recommended.

- Caveat: Internal policies and procedures likely will differ among OCIOs. Unless you investigate and adjust for these differences, you can’t assume a level OCIO performance playing field – even if the OCIOs are GIPS compliant.

- Additionally, it is also strongly recommended, but not required, that firms undergo an independent, third-party verification.

Despite these serious caveats, we believe GIPS compliance is a positive development as long as clients understand its limitations and ask an OCIO the right questions about composite construction, benchmark selection, and the definition of discretion, including:

- What is your definition of discretion?

- What benchmarks do you use, and why do you believe these benchmarks are the most appropriate for the composite(s)? What is your policy regarding adoption and inclusion of legacy assets in the composite(s)?

- What is the weighted average asset allocation of the composite(s)?

A good OCIO will be happy to answer these questions and make it as easy as possible for clients to assess its performance against that of other providers.

Strategic Investment Group® claims compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. To obtain a fully compliant GIPS report, please contact us at info@strategicgroup.com.

OCIO-Client “Chemistry”

Last, but certainly not least, in addition to evaluating an OCIO’s services and business practices, it’s important to pay attention to which OCIO provider feels right for your organization’s unique situation. An OCIO arrangement is meant to be a long-term partnership. You should have the sense that the culture of the OCIO aligns with that of your organization. Whatever your organization values – be that transparency, trust, commitment, flexibility, discretion, or otherwise – the investment committee should pay attention to whether an OCIO values those qualities as well. Talk to the OCIO’s references about their experiences in this regard.

The investment committee also should get the level of attention that makes it feel comfortable. This can be both a matter of OCIO size and service ethic. Is the OCIO small enough to provide devoted and focused service? Is it large enough to implement sophisticated investment portfolios and maintain robust systems? As a client, will the investment committee be able to speak with senior management, the members of the investment team, or anyone in the firm for that matter? Is the OCIO willing to go the extra mile when unexpected situations arise? Find out who on the OCIO's team will work with the investment committee and attend organization meetings.

The reactions you have when interviewing an OCIO firm are likely an indicator of whether you will bond as the relationship develops.

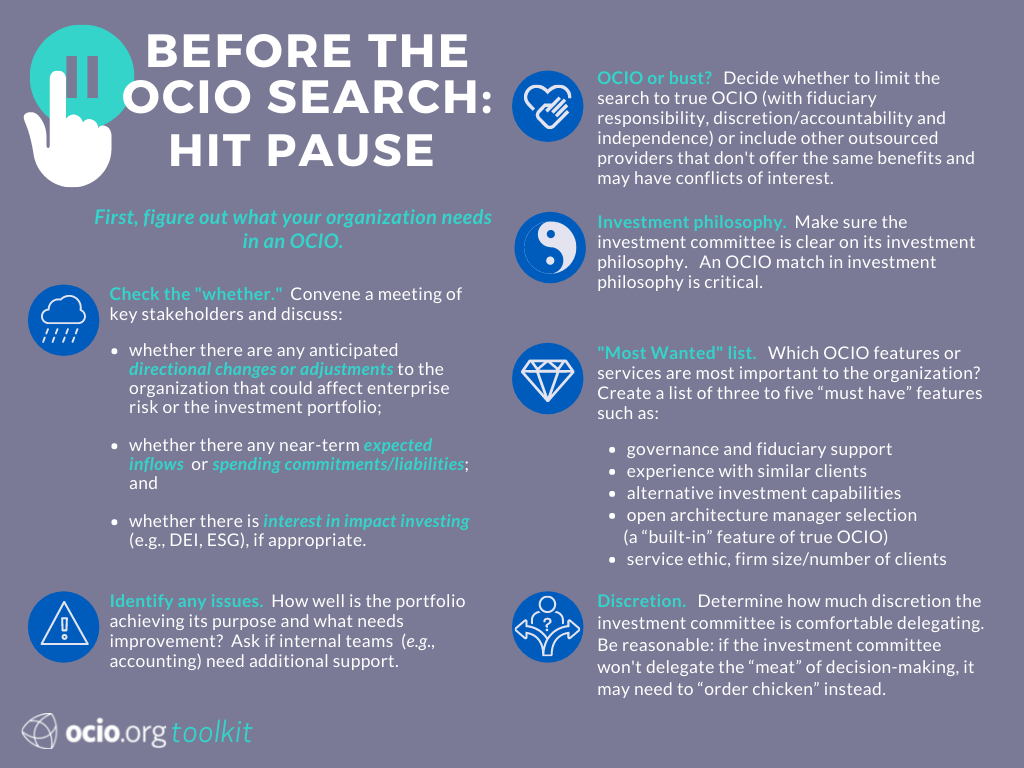

Step Two: Understanding What You Want in an OCIO

Once an investment committee has decided to look for an OCIO, there is a tendency to rush straight into the search process. In our experience, the most productive OCIO searches start with an investment committee that has taken the time to figure out what it wants from an OCIO – both for the organization and for itself. For this reason, before the investment committee starts looking for an OCIO, we recommend the investment committee determine:

- the current condition or “state of affairs” of the organization; and

- the current thinking or “state of mind” of the investment committee on what it’s looking for in an OCIO.

We provide some detailed considerations below and encourage you to record your findings.

State of Affairs: What is the condition of the organization?

Outreach to stakeholders. We recommend the investment committee meet with the Board (or equivalent) and the organization’s senior leaders about the plan to search for an OCIO. The investment committee will want to ensure these important stakeholders are not blindsided and, in the process, create an opportunity to get their input and rally support. If the organization hasn’t outsourced in the past or if you have outsourced to a non-OCIO provider, the investment committee should be prepared to explain the basics of OCIO and how the committee members think OCIO will benefit the organization.

Check the “whether.” The next step is to review the purpose of the investment assets with the Board and senior management and ask:

- whether senior management is planning or anticipates any directional changes or adjustments to the organization that could affect enterprise risk or the demands on the investment portfolio;

- whether senior management is aware of any near-term expected inflows (e.g., from fundraising or revenue-generating activities) or spending commitments/liabilities; and

- whether there is interest in values-driven investing (e.g., ESG, DEI, sustainability, impact), if appropriate.

Identify any issues: Finally, all parties should discuss how well the portfolio is achieving its purpose (i.e., whether it generates sufficient assets to meet the organization’s stated needs). Discuss what is working and what needs improvement. Ask whether internal staff members (for example, the accounting department) could benefit from additional support.

State of Mind: What is the investment committee looking for in an OCIO?

During the OCIO search process, the investment committee will have the opportunity to explore the characteristics and service offerings of various OCIO providers and consider what combination of these will work best for the organization. Having said this, there are certain areas where the investment committee should come to at least a preliminary agreement of what it wants from an OCIO before beginning the search. We recommend you discuss the items below and record your decisions.

OCIO or Bust?

OCIOs are a specific subset of outsourced investment providers. Built into the OCIO name – and the OCIO model – is a firm commitment to give clients the integral benefits of an internal chief investment officer, namely, a partner that:

- bears a fiduciary responsibility to the organization;

- accept investment discretion and primary accountability for performance; and

- remains independent of any affiliations, financial arrangements, or outside business lines that could conflict with the best interests of the organization.

During the search process, the investment committee may encounter a number of outsourced service providers that call themselves OCIOs but do not meet these criteria. These providers may offer valuable services, but they are not OCIO. The investment committee should consider the pros and cons of OCIO versus other outsourcing models and decide at the outset whether it wants to limit its search to OCIO or include other outsourced providers (regardless of what they call themselves). Understanding the difference between an OCIO and other outsource providers will help the committee understand what the candidates are offering and inform what questions to ask.

Firms that offer both consulting and OCIO. Some investment committees have difficulty choosing between a consultant and an OCIO. As a “solution,” an investment committee may hire a consulting firm that also offers OCIO services. The idea is that the investment committee will hire the firm’s consulting division to start. Then, if the committee decides later on that it needs the additional support of OCIO services, the switch over to the OCIO division will be easy and seamless. While this seems like a reasonable approach, there are downsides. The team assigned to the organization’s account will change in the switch from the consulting to OCIO divisions. In addition, it is not unusual for the OCIO arm of a consulting firm to adopt more passive investment strategies, so the OCIO team may sell the organization’s assets and start over. There are also structural issues with the dual consultant/OCIO model that are discussed in the "What is an OCIO?" section under "What about consultants that also offer OCIO?".

Investment Philosophy

It is critical that an investment committee and OCIO share the same investment philosophy. A mismatch inevitably will result in dissatisfaction on both sides of the OCIO relationship, and this is not a mere detail that can be worked out once the OCIO relationship has been established. If the investment committee hasn’t discussed the topic of investment philosophy recently, don’t assume all members are in agreement. Have a frank discussion and either come to a consensus or, at a minimum, identify investment philosophy as something to explore further with OCIO candidates before committing to a relationship. If the investment committee does have a strong conviction in a particular investment philosophy, this can help narrow the OCIO search.

Most Wanted List

Which OCIO features or services are most important to the organization? Some investment committees report losing the ball in the sun during the search process because they did not identify their key requirements beforehand. We recommend that the investment committee create a list of three to five “must-have” features and then go back to that list to score candidates during the search process. Some examples of decision points include:

- governance and fiduciary support;

- experience with similar clients;

- alternative investment capacities;

- open architecture (again, this is a “built-in” feature of true OCIO);

- level of client service (which can be a function of firm size, number of clients, and assets under management); and

- preservation of certain legacy investments.

Investment Control

The OCIO model by definition requires some delegation of investment control from the investment committee to the OCIO. In the case of a Single Portfolio implementation system, the OCIO has full control over the fund’s underlying investments. The Hybrid implementation system is the same with respect to underlying investments, but the OCIO may allow the investment committee some level of control over the allocation of the organization’s assets between the sleeves or series of the fund. For fully customized accounts, there are more control options. For example, an investment committee could create lists of restricted securities, place limits on allocations to certain asset classes, establish credit quality requirements, or require that the investment committee be included at critical decision points in changing asset allocations or hiring managers. The investment committee needs to determine its comfort level with discretion before the search process so that it can communicate any desired limitations to OCIO candidates and make sure they can be accommodated reasonably within an OCIO’s investment process.

For the true OCIO model (with fiduciary status and without conflicts of interest in the manager selection process), we recommend a full delegation of investment control.

Why?

- Few investment committees have the time or breadth of technical expertise to adequately vet and monitor managers or execute timely tactical allocations.

- Because an OCIO is legally a co-fiduciary (or, in the case of an employee retirement plan a “named fiduciary”) of the organization’s investment assets, the investment committee can shift the nature of its responsibility from one of continuous manager selection and review to periodic supervision of the OCIO’s processes.

- Delegation of control allows the investment committee to focus on responsibilities that it is structurally better suited to fulfill and that cannot be delegated to a third party, namely – strategy, policy setting, and oversight.

- An OCIO that has full control over an organization’s assets also has full accountability for the performance of the portfolio.

An investment committee that retains too much control over decision-making risks defeating the purpose of hiring an OCIO. At some point, if the investment committee isn’t comfortable delegating the “meat” of decision-making to an OCIO, then it may be better off “ordering chicken” instead.