Transition to OCIO

A smooth "hand-off" requires communication and cooperation.

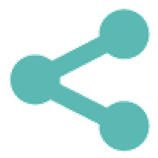

A typical transition takes a minimum of three to five months. Communication and cooperation between the organization and the OCIO are critical to making sure the organization’s assets are (re)deployed by the OCIO as soon as possible. There are many moving parts to an OCIO transition, but it helps to break it down into three phases: documentation, transfer, and implementation.

Phase One: Document the Relationship

In the documentation phase, the organization and the OCIO negotiate and execute an investment management agreement (IMA). They also complete all the authorization paperwork and systems necessary to transfer control over the organization’s existing portfolio assets to the OCIO.

Execute the Investment Management Agreement (IMA)

Most organizations hire a law firm (typically an Investment Advisers Act of 1940 specialist) to assist in the drafting and negotiation of the legal terms of the IMA. Some search consultants also offer assistance with the non-legal terms (e.g., appropriate benchmarks for performance measurement). Make sure the IMA nails down all the key business terms discussed during the selection process, with particular attention to the implementation system(s), the level of discretion granted to the OCIO, any investment restrictions or requirements, and fees. If there was a particular member of the OCIO team who promised to attend the organization's meetings and that was important to the investment committee, we would suggest you add this to the IMA.

Also, watch out for any “duration traps” – namely, penalties or restrictions imposed on the exit of the organization from any of the OCIO’s implementation vehicles – especially those that the organization may have to keep if it terminates the OCIO relationship. In the case of OCIO implementation vehicles that contain illiquid investments, an organization may wish to retain these investments to maintain its diversified vintage-year exposures, and it is understandable that the OCIO may not be able fully to redeem the organization from those vehicles until sales on the illiquid assets are realized. However, the client should pay attention to these fees upon hiring the OCIO, because although it is reasonable that the OCIO would charge a fee for the continued management of these funds, some OCIOs have standard fees more than twice other OCIOs.

A note on IMAs for non-OCIO outsourcing relationships:

If you have chosen an outsourcing provider that generates additional revenue from OCIO relationships through the use of proprietary products or affiliated brokers, or revenue-sharing arrangements with managers and other service providers (as opposed to a true OCIO that is paid solely based on assets under management and performance), you may wish to consider limiting the use of those products, services and/or arrangements in the IMA. Placing a cap on the percentage of the organization’s assets that may be susceptible to conflicts of interest will help reduce the conflict-monitoring burden on the investment committee and encourage your outsourcing provider to consider a wider range of managers/service providers.

Prepare Transfer Documentation and Communication Systems

Concurrent with the negotiation of the IMA, the organization provides the OCIO with its governing documents, “know your customer” or “KYC” information, and evidence of tax status, and then notifies its custodian and each of its existing managers that the OCIO will have signatory authority going forward. The OCIO, in turn, arranges its internal systems to communicate trade instructions/confirmations and position information with the organization’s custodian and managers. The OCIO also establishes communication and reporting protocols with the organization.

Consider one month of overlap with the organization’s prior provider:

If the organization is switching from another OCIO or outsourcing provider, an overlap can help reduce the chances that the organization will lose market exposure while the new OCIO is working to get the transfer documentation, communication systems and custodial interface ready to “go live.” While this represents a bit of extra expense, some organizations report that maintaining market exposure during the documentation phase saved them hundreds of thousands of dollars.

Phase Two: Transfer Existing Portfolio/Develop IPS and Transition Plan

Asset Transfer

In this phase, the OCIO typically assumes control and fiduciary responsibility over the organization’s assets and manages them according to the organization’s existing investment policy. The OCIO also handles all cash flows (including rebalancing, capital calls, and return of capital/distributions) and performs all front and back-office functions for the organization.

The Investment Policy Statement

The investment committee and OCIO also begin work on the Investment Policy Statement (IPS). The elements of a typical IPS can be broken down into three categories.

Goals and Duties – The IPS should define the assets covered by the policy, clarify the roles and duties of the key stakeholders (the organization’s governing board, the investment committee, internal staff, the OCIO, and other essential service providers such as the custodian).

Portfolio Objectives – This section of the IPS includes:

- The portfolio’s investment objectives.

- Risk Profile – The acceptable return volatility (risk tolerance parameters) for the portfolio.

- A strategic asset allocation plan – a list of permitted asset classes (and the rationales for including them in the portfolio), a target allocation for each asset class, and allowable ranges of deviation from those targets. The asset allocation plan also may include any investment restrictions or guidelines, such as currency policy or “values-based investing” considerations (e.g., DEI, ESG, impact, and sustainability).

- A liquidity policy – How much of the organization’s portfolio should be held in assets that are readily convertible to cash (without a significant price impact) to accommodate the spending policy.

- A spending policy – The rate at which the organization can spend based on its expected returns/asset allocation/organizational priorities.

Monitoring and Review – Finally, the IPS should establish:

- Return expectations and performance measurement metrics, including applicable benchmarks.

- A rebalancing framework (including ranges/triggers).

- Monitoring criteria and frequency.

(For a more detailed discussion of IPS considerations, click here.)

Why is the OCIO involved with the IPS?

Although the IPS, as a document, technically “belongs” to the organization (as opposed to the OCIO), it is crucial that the new OCIO offer changes and improvements based on the OCIO’s experience and expertise so that the policy statement will best position the committee to overcome inevitable challenges that the organization will face. The OCIO should help the investment committee draft a policy statement that is best designed to meet the organization's needs and documents the roles of the key stakeholders.

As we have previously noted, before hiring an OCIO, many investment committees will have spent the bulk of their time hiring, firing, and reviewing individual managers. And few will have had access to the analytical tools required to model the expected investment outcomes of different risk and asset allocation parameters. As a result, the organization’s existing objectives may be based more on intuition, than financial data and rigorous, quantitative analysis. An OCIO will have tools to help the investment committee better understand the level of risk in the organization’s portfolio and how that might change under a range of different investment scenarios. Working together, the investment committee and its OCIO can achieve a more quantitatively integrated view of the investment portfolio and determine the risk/return balance that will best support the organization’s core goals.

How does an OCIO relationship affect the responsibilities of the organization’s board and investment committee?

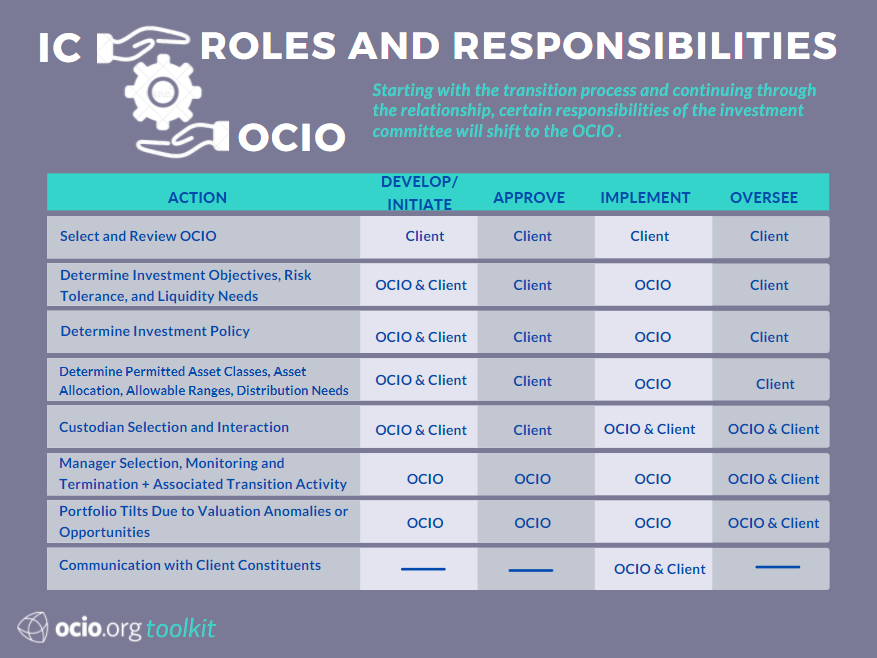

As noted above, an important function of the IPS is to clarify the roles and responsibilities of the organization’s internal and external stakeholders. An organization that is new to an OCIO relationship will have to make significant changes to its existing “seating chart.” Without clear guidance, it is likely that the various parties will make incorrect and, possibly, conflicting assumptions about what they are permitted/expected to be doing.

Because organizations have different structures and objectives, there naturally will be some variation in roles and responsibilities following the hiring of an OCIO. As a general rule, the interaction of the governing board and the investment committee will remain largely the same. The governing board will retain its high-level control over and oversight responsibilities with respect to the investment committee, for example:

- Control over the investment committee structure, including its internal hierarchy, number of seats, and selection of the committee chair;

- Final decision-making authority (based on investment committee recommendations) over the IPS, which includes long-term asset allocation targets, ranges for each asset class, and any changes that may be required over time; and

- Monitoring the investment committee’s supervision of the OCIO and the portfolio by checking in with the investment committee on a regular basis and reviewing any major decisions the investment committee may take, including the possible termination of the OCIO relationship.

However, a more significant change will occur for the investment committee. On the one hand, it’s important for the investment committee members to accept the OCIO delegation and resist the temptation to micromanage or reinsert themselves into daily decisions. On the other hand, the investment committee members also need to understand that they cannot absolve themselves of their fiduciary duties by hiring an OCIO. The chart below can help model a reasonable division of responsibilities between an investment committee and its OCIO.

Typical division of responsibilities between an investment committee and OCIO.

The Transition Plan

After the organization approves the new IPS, the OCIO evaluates incumbent managers against the new policy and develops a detailed transition plan with input from the organization. It is worth noting here that some OCIOs carefully review the organization’s existing managers to see whether any should be incorporated into the OCIO’s new recommended lineup (potentially reducing transaction costs), whereas others simply terminate all of the organization’s existing, liquid managers and start over. If you have managers you wish to keep or have strong feelings about the way in which the OCIO handles the existing portfolio, we recommend that you communicate those preferences as early as possible in this phase of the transition. Also, if the IPS imposes any restrictions or specifies particular considerations for the portfolio’s investments – (e.g., “values-based investing” considerations such as DEI, ESG, impact, and sustainability) – the OCIO and the investment committee should discuss and decide how best to implement them.

Phase Three: Implement Revised IPS

In the implementation phase, the OCIO executes the transition plan by coordinating manager transitions and executing new sub-manager agreements and subscription documents. Phase three is complete when substantially all assets (excluding illiquid legacy investments) are deployed according to the transition plan. At this point, the OCIO provides a comprehensive transition review to the investment committee, and the clock starts on the OCIO’s accountability for performance.