Establish Roles and Responsibilities

From the outset, be clear on the OCIO’s roles and responsibilities, and make sure existing stakeholders understand how their own responsibilities will change.

Partnering with an OCIO should feel like the organization has added a group of highly-experienced team members to its ranks. In a typical OCIO partnership, the OCIO assumes responsibility for all (or at least most) of the day-to-day tasks involved in managing the organization’s portfolio. The investment committee’s responsibility for those tasks then shifts from direct action to supervision of the OCIO’s execution and performance. Ideally, the OCIO takes a significant burden off the shoulders of the investment committee, and allows the committee to focus on its essential roles of strategic direction and oversight.

This arrangement sounds straightforward – and it can be – but only if the scope of the OCIO delegation is clear and the investment committee members (and other stakeholders) understand how to fulfill their changed roles moving forward. On the one hand, it’s important for the investment committee members to accept the OCIO delegation and resist the temptation to micromanage or reinsert themselves into daily decisions. On the other hand, the investment committee members also need to understand that they cannot absolve themselves of their fiduciary duties by hiring an OCIO.

We strongly recommend that the roles and responsibilities of all the key stakeholders – including at a minimum, the governing board, the investment committee and the OCIO – be delineated clearly and in writing. Without clear guidance, it is likely that the various parties will make incorrect and, possibly, conflicting assumptions about what they are permitted/supposed to be doing. The IPS is the ideal location for this record, but it should, at a minimum, be in the form of an operating policy formally adopted by the board.

Because organizations have different structures and objectives, there naturally will be some variation in roles and responsibilities. However, as a general rule, the interaction of the governing board and the investment committee will remain largely the same. The governing board will retain its high-level control over and oversight responsibilities with respect to the investment committee, for example:

- Control over the investment committee structure, including its internal hierarchy, number of seats, and selection of the committee chair;

- Final decision-making authority (based on investment committee recommendations) over the language of the IPS and any changes that may be required over time; and

- Monitoring the OCIO and the portfolio through regular reviews and supervision of the performance of the investment committee and any major decisions it may take, including the possible termination of the OCIO relationship.

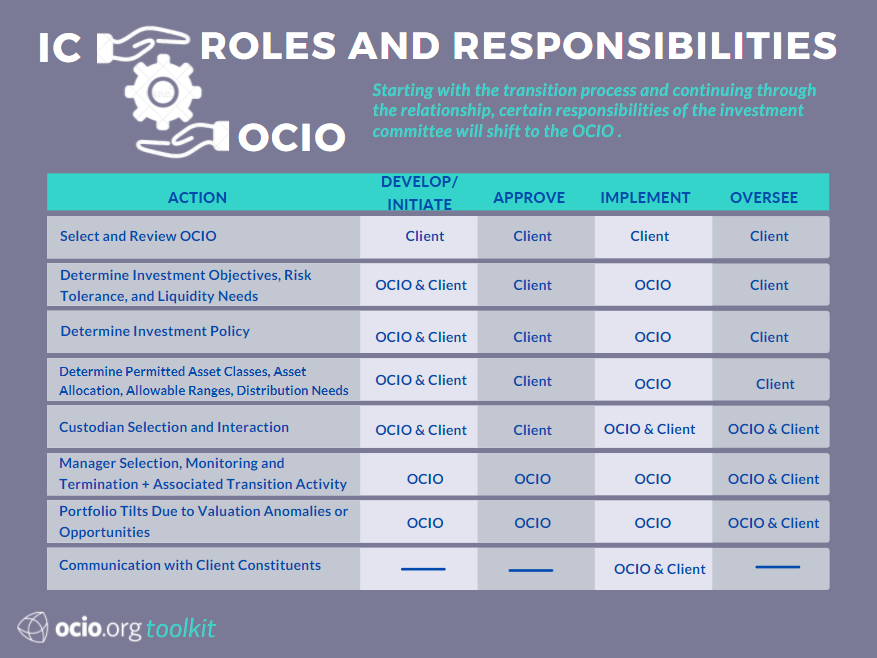

A more significant change will occur for the investment committee, as demonstrated in the chart below.

Typical division of responsibilities between an investment committee and OCIO.

A true OCIO – one that is accountable for investment implementation and performance and does not have financial ties to any managers/service providers – will free up significant time for the investment committee members to dedicate to other matters. The investment committee members should discuss how to reallocate this newfound time to key areas that will have the greatest impact on future returns, such as: strategic asset allocation, risk tolerance (in the context of the rest of the assets on the organization’s balance sheet), and the portfolio’s optimal liquidity profile. Reviewing governance also should be a priority. If there are other agenda items on the backburner, the completion of the transition process is an opportunity to revive them and assign specific tasks to committee members. The key is to discuss specifically what the members will do going forward.